Avoiding Common Tax Mistakes: A Guide for Canadian Businesses

Understanding Tax Obligations

For Canadian businesses, staying compliant with tax obligations is crucial to avoid penalties and maintain a clean financial record. Understanding the specifics of what taxes apply to your business can be complex, especially with varying regulations at the federal and provincial levels.

Registering for the Right Taxes

It's essential for businesses to register for the appropriate taxes. This can include the Goods and Services Tax (GST), Harmonized Sales Tax (HST), or even provincial sales taxes. Knowing which apply to your business type and location can prevent costly mistakes down the road.

For instance, if your business exceeds $30,000 in gross revenue over four consecutive calendar quarters, you must register for GST/HST. Failing to do so can lead to interest charges and penalties.

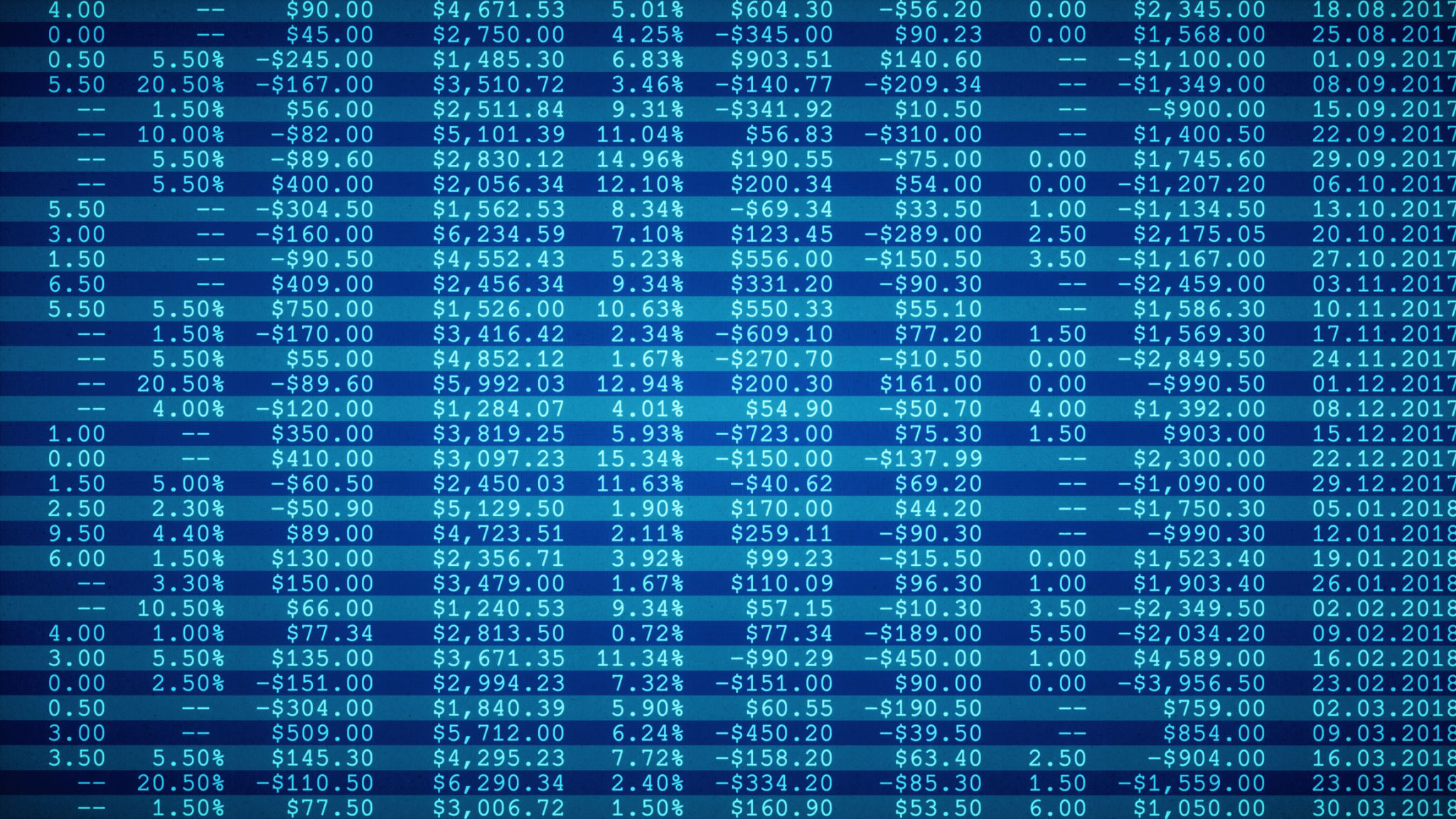

Keeping Accurate Financial Records

Accurate record-keeping is the backbone of any successful business. Proper documentation ensures that all income, expenses, and deductions are correctly reported, minimizing errors during tax filing season.

Importance of Regular Audits

Conducting regular internal audits can help identify discrepancies early and ensure compliance. These audits should review all financial transactions and ensure that your records align with your tax filings.

Claiming Deductions and Credits

Taking advantage of available tax deductions and credits can significantly reduce your tax liability. However, it's important to understand which deductions your business qualifies for and how to claim them appropriately.

Common Deductible Expenses

Some common deductible expenses include utility bills, office supplies, and professional fees. Be sure to maintain receipts and documentation for all claimed expenses, as these may be required in the event of an audit.

Filing Taxes on Time

Timely filing of taxes is crucial to avoid late fees and penalties. The Canada Revenue Agency (CRA) has specific deadlines for filing, which vary depending on your business structure.

Understanding Deadlines

Sole proprietors and partnerships, for example, must file their taxes by June 15th each year, though any taxes owed are due by April 30th. Corporations have different deadlines based on their fiscal year-end.

Seeking Professional Help

While some businesses manage their taxes independently, seeking professional help from accountants or tax consultants can provide peace of mind. These experts can offer guidance on complex tax issues and ensure compliance with all regulations.

By avoiding these common tax mistakes, Canadian businesses can focus more on growth and less on financial headaches. Ensure that your tax strategy is sound and compliant to keep your operations running smoothly.